Media personality J.J. Omojuwa recently shared a thought-provoking encounter with a man who approached him for financial assistance to kickstart a business. The man requested a loan of ₦300,000 to establish a POS business for his wife, a seemingly good idea on the surface. However, the conversation took a different turn when Omojuwa delved deeper into the man’s financial history.

In a post shared on the X platform, Omojuwa revealed that during their discussion, he asked the man about the expenses incurred during his wedding, which had taken place the previous year. To his surprise, the man disclosed that he had spent a staggering ₦1.7 million on the ceremony despite earning a modest annual salary of ₦720,000. This revelation prompted Omojuwa to question the man’s financial priorities and decisions.

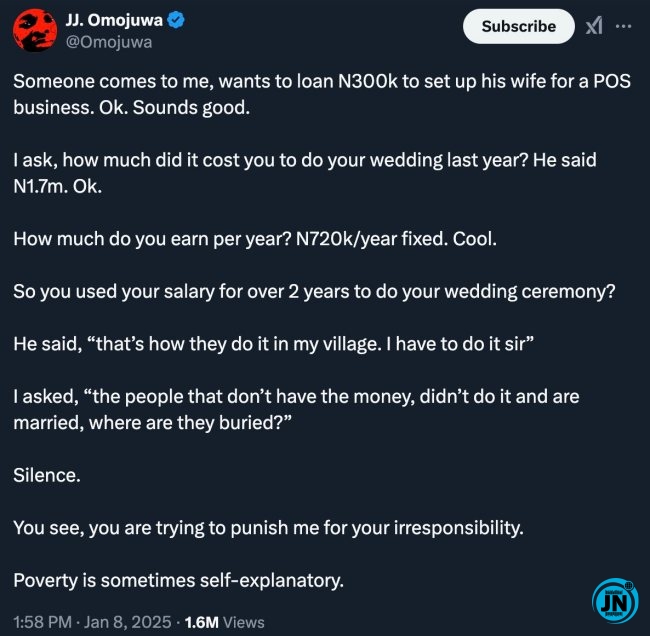

“Someone comes to me, wants to loan ₦300k to set up his wife for a POS business. Ok. Sounds good. I ask, how much did it cost you to do your wedding last year? He said ₦1.7m. Ok. How much do you earn per year? ₦720k/year fixed. Cool. So you used your salary for over 2 years to do your wedding ceremony?” Omojuwa recounted in his post.

When the man attempted to justify his actions by stating that it was customary in his village to have a lavish wedding, Omojuwa did not hold back. He pointedly asked, “The people that don’t have the money, didn’t do it, and are married, where are they buried?” This response reportedly left the man speechless, highlighting the societal pressures and cultural expectations that often drive individuals to make financially unsound decisions.

Omojuwa concluded his post with a sharp observation: “You see, you are trying to punish me for your irresponsibility. Poverty is sometimes self-explanatory.” His remarks sparked widespread debate online, with many social media users weighing in on the societal norms surrounding extravagant weddings and their impact on individuals’ financial well-being.

The post has since garnered significant attention, igniting discussions on financial literacy, responsibility, and the undue influence of societal expectations on personal choices. Many users have expressed agreement with Omojuwa’s stance, emphasizing the importance of prioritizing long-term financial stability over fleeting societal validation.

Others, however, argued that cultural norms and family expectations often place immense pressure on individuals, making it challenging for them to prioritize pragmatism over tradition. The conversation continues to resonate with many, shedding light on the delicate balance between cultural values and financial responsibility.